Advice from a teen investment trader: learn to fail, even when your money’s on the line

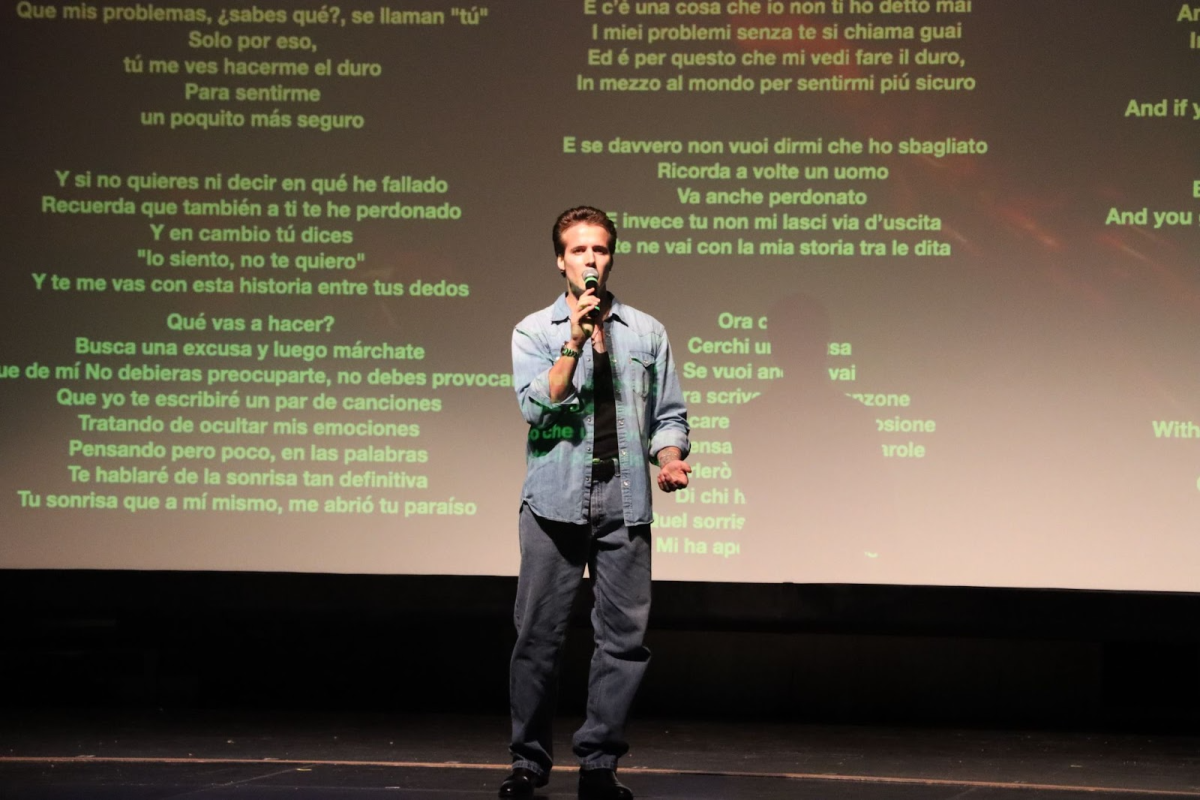

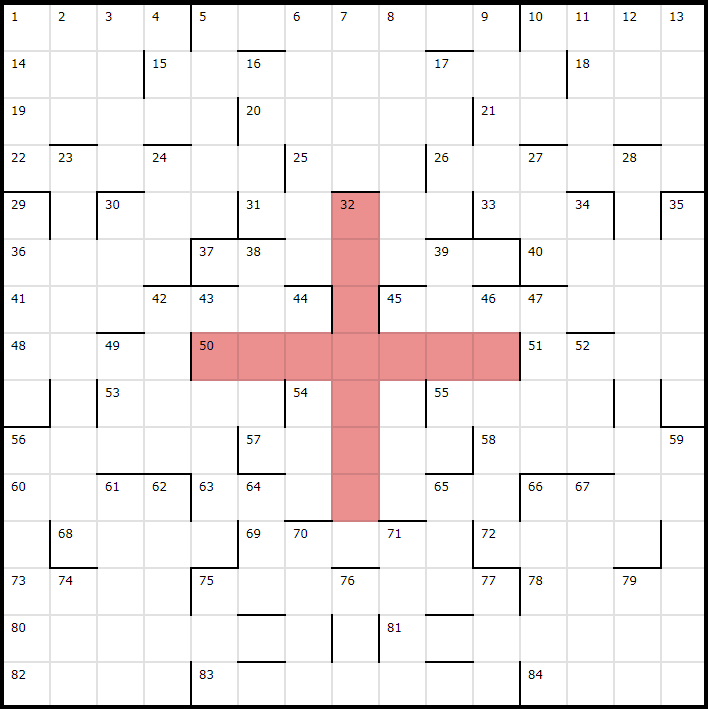

While examining stock charts, senior Brandon Fong searches for potential catalysts and patterns. He also draws support or resistance lines to help with his analysis.

September 23, 2020

Wake up at 5:45 a.m., get dressed, scarf down a quick breakfast and sit down in front of a monitor setup that looks like it belongs to the world’s best hacker. For Burlingame senior Brandon Fong, waking at an ungodly hour is the norm. Why? It’s when the New York Stock Exchange opens.

Trading is the process of buying a stock at a low price, and selling it when the price rises, so the trader earns a profit. Fong opened his trading account at the beginning of his sophomore year, his parents contributing half of the $2800 needed to start the account. However, he only started investment trading in March 2020. As with all new traders and investors, when Fong first began trading, there was a significant learning curve.

In fact, losing money is inevitable for both new and seasoned traders, and for new traders, big initial losses are often regarded as the “tuition” for learning how to trade.

“[The first time I lost money] I didn’t really know how to handle it because I’ve never lost that amount of money in such a short amount of time. So I reflected and went back and looked at the charts. Looked at what I could have improved on and tried to understand why I even traded that,” Fong said.

Stock trading is more than a part-time hustle or job — it’s a lifestyle. In addition to spending hours scrutinizing stock charts, Fong also dedicates time to learning new indicators and patterns, all while keeping up with the news and monitoring prices when he’s not trading.

To help others in their stock endeavors, Fong set up a Discord server, which currently has 66 members. On the server, Fong documents patterns he observes in the market, his future projections and the strategies he employs when trading in order to help members.

“[The purpose of the server] is to collaborate with other people to get their perspectives on things like stocks, charts, etc. It’s just a community for people to interact with one another, and for me to express my own thoughts,” Fong said.

Last year, Fong founded the Common Cents Investment Club at Burlingame, aiming to introduce the stock market to students. This year, he plans to host weekly Zoom calls, and teach club members about a new topic each week.

Although Fong’s interest in trading was sparked by curiosity of having your money work for you, as he became more experienced, he discovered that the core value of trading stocks was much more profound — learn to fail.

“If you haven’t experienced failure, then you’ll have a higher amount of losses in the future. When you embrace failures and overcome challenges it will allow you to develop resilience,” Fong said.